Is BYD owned by China?This question often becomes the focus of discussion and even a point of criticism.

The teacher once said: “Who is our enemy and who is our friend? This question is the primary question of the revolution.”

The following two perspectives reveal BYD’s past.

1. From the perspective of equity structure: BYD’s domestic capital accounts for the majority

BYD’s equity has undergone a transformation from all domestic capital to domestic and foreign capital participation, with the proportion of the two being: 62.28% domestic capital and 37.72% foreign capital.

The specific process is divided into two stages:

The first stage: the all-domestic capital stage, that is, the stage of BYD’s overall restructuring.

At that time, the total number of common shares issued by BYD was 390 million shares, all of which were held by the promoters, 100% domestic capital.

The second stage: five additional issuances of foreign capital shares, forming a situation of domestic and foreign capital participation.

The first additional issuance of foreign-invested shares was 149.5 million shares. After the issuance, BYD’s equity structure was: 72.29% domestic shares; 27.71% foreign shares.

The second additional issuance of foreign-invested shares was 225 million shares. After the issuance, BYD’s equity structure was: 65.14% domestic shares; 34.86% foreign shares.

The third additional issuance of foreign-invested shares was 121.9 million shares.

The fourth additional issuance of foreign-invested shares was 133 million shares.

The fifth additional issuance of foreign-invested shares was 50 million shares.

During this period, BYD also issued additional domestic shares.

The final equity structure of BYD was: 291,114.2855 million common shares, of which 181,314.2855 million were domestic shares, accounting for 62.28%; overseas listed foreign-invested shareholders held 109.8 million shares, accounting for 37.72%. (Data as of June 2024)

So, from the perspective of equity structure, BYD is a Chinese company with a majority of domestic capital.

2. From the perspective of shareholders, Chinese shareholders are dominant

From the list, the largest shareholder is HKSCC NOMINEES LIMITED, holding 37.7% of the shares, and the nature of the shares is foreign-funded tradable shares, that is, foreign-funded shares.

In fact, the Chinese name of the company is Hong Kong Central Clearing Agency Co., Ltd., which has a similar role to China Securities Depository and Clearing Co., Ltd., but is responsible for registering the ownership of BYD’s overseas shares.

Simply put, the 37.7% held by HKSCC NOMINEES LIMITED is the sum of the number of all overseas shareholders. In other words, although HKSCC NOMINEES LIMITED holds 37.7%, it is not the controlling shareholder of BYD.

According to BYD’s disclosure, its controlling shareholder is Wang Chuanfu, holding 17.81% (as of June 2024). At present, Wang Chuanfu is a Chinese citizen and has not obtained residency in other countries.

As for Wang Chuanfu’s spouse Li Ke, he is also a Chinese citizen. It is unknown whether he has obtained residency in other countries.

There is no public information about the nationality of the family members of the actual controller.

As for the question of the nationality of Wang Chuanfu’s children by some netizens, there is no public information and it is a personal privacy issue. It is not recommended to speculate and spread.

From the above two dimensions, BYD is a company with a majority of domestic capital and controlled by Chinese natural persons. In other words, BYD is a Chinese company.

3. BYD should have the responsibility and awareness.

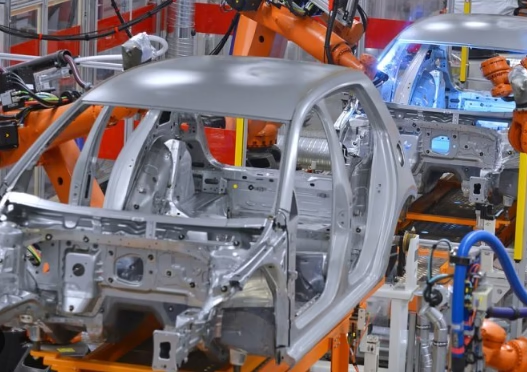

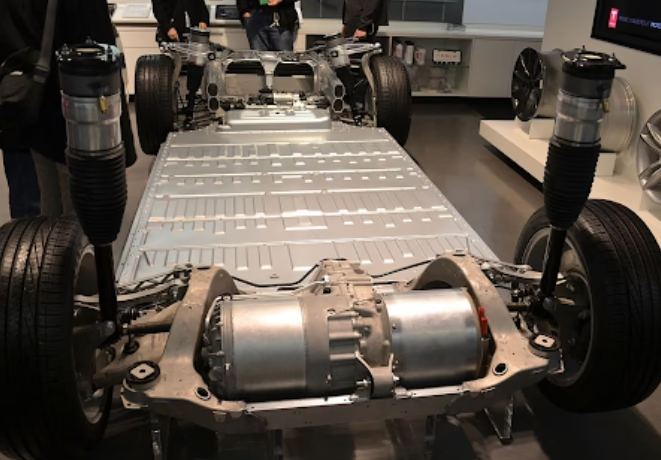

Today, BYD is leading the field of new energy vehicles, with sales far ahead of others, showing the potential and signs of a giant.

As a Chinese company, BYD’s products go overseas to occupy the market, invest in overseas factories, and export brands and technologies, which have a driving role in establishing Chinese brands and deserve praise.

Some people say that there are two major “law protectors” that have an objective driving role in the development of national brands. One is “patriotism law protector” and the other is “nationalism law protector”.

BYD has also used words like “Chinese brand” in its publicity. I have no comment on this kind of publicity method.

Populism is a double-edged sword. It is very popular when used well, but it is easy to be backfired.

But Chinese car companies should have the necessary awareness and responsibility. There are mainly the following aspects:

1. Chinese car companies should focus on cultivating the industry chain and coexist and prosper with the upstream and downstream of the industry chain, rather than squeezing suppliers and transferring financial pressure, R&D pressure, and cost pressure to suppliers.

The crude low-price bidding management model will only force suppliers to pass off inferior products as good ones and follow the old path of Japanese car fraud.

2. On the issue of employment, the results of rapid development should be shared with employees, and price wars should not be launched to gain cost advantages by squeezing employees to the extreme.

In terms of composition, BYD is a Chinese company, but it is fundamentally different from SAIC, FAW, Dongfeng and GAC, which are pure-blooded state-owned enterprises.

State-owned enterprises play a bottom-line role in the cultivation of the industrial chain, employee welfare, social welfare and responsibility, and this bottom line should not be broken by private enterprises.

For private enterprises in China, the founders may have original intentions, but the successors may not be loyal.

Is BYD owned by China?As a Chinese company, BYD has become the leader of China’s automobile industry and is moving towards the world’s automobile sales champion. At present, BYD is actively deploying overseas markets, investing in overseas factories, and exporting brands and technologies, which has a driving role in establishing Chinese brands and deserves praise!

Leave a Reply