Development Status and Trends of the Auto Parts Industry in 2025: In 2025, when the global automotive industry is accelerating its transformation to the “New Four Modernizations” (electrification, intelligence, networking, and sharing), as the core cornerstone supporting the development of the automotive industry, the auto parts industry is undergoing a dual reconstruction of the technology paradigm and value system. Standing at the key node of industrial transformation, analyzing the underlying logic and evolution direction of industry development has important practical significance for corporate strategic layout and industrial policy formulation.

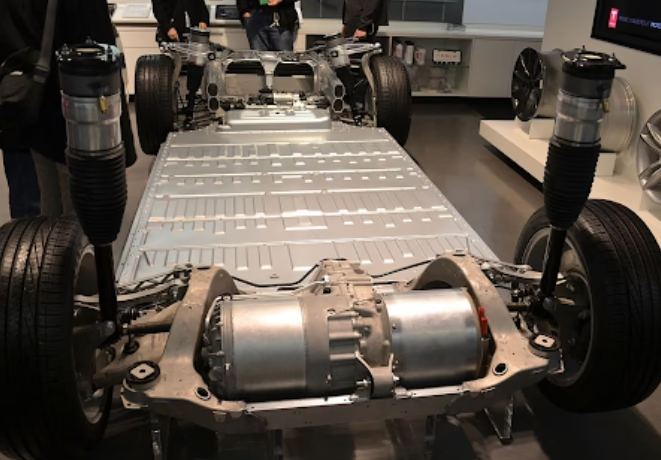

The scale of China’s auto parts market is expected to reach 6.79 trillion yuan in 2025, with an annual compound growth rate of more than 8%, leading the world in growth rate. The penetration rate of new energy vehicles has rapidly increased to more than 40%, driving a surge in demand for “three-electric systems” (batteries, motors, and electronic controls) and intelligent components, and the proportion of new energy-related parts has exceeded 60%. The global market is expanding simultaneously, and the scale is expected to reach 3.07 trillion US dollars in 2029, with an average annual growth rate of 3.6%. China has become a core supplier with its cost-effective products.

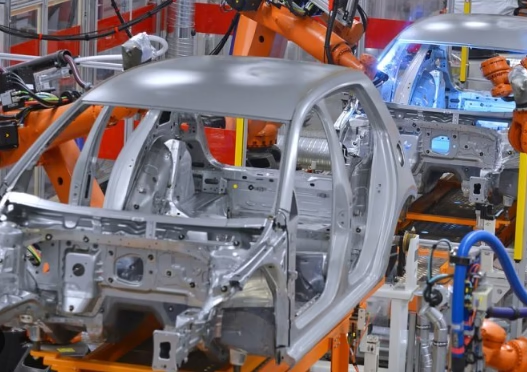

1. Electrification and intelligence reshape the industrial landscape

In 2024, China’s new energy vehicle production and sales will reach 12.888 million and 12.866 million respectively, accounting for 40.9% of the total new car sales, driving a surge in demand for core components such as batteries, motors, and electronic controls. The EU’s new carbon emission regulations for 2025 require that the average emissions of new cars be reduced to 95 grams per kilometer and zero emissions be achieved in 2035, forcing companies to accelerate green transformation. Although the retail share of Chinese auto parts companies’ own brands has reached 64%, they still rely on imports in areas such as high-end chips and precision sensors, and the “stuck neck” problem needs to be broken through.

Domestic market competition has intensified, foreign brands have accelerated their localization layout, local leading companies have expanded their market share through mergers and acquisitions, and small and medium-sized enterprises have narrowed their living space under cost and technical pressure. At the same time, China’s spare parts exports have grown against the trend, with exports reaching US$87.03 billion from January to October 2024, a year-on-year increase of 5.7%, and the recognition of Chinese products in the North American and European markets has increased significantly.

2. The transformation of domestic parts from “following” to “leading”

The role of national policies in promoting domestic substitution of auto parts is becoming more and more significant. The increase in the old-for-new policy and the support of local industrial clusters have created a good development environment for domestic substitution.

At the same time, the expansion of the global and domestic market scale, especially the rapid increase in the penetration rate of new energy vehicles, has provided a broad market space for domestic parts. In 2025, the global automotive parts market is expected to exceed 1.5 trillion US dollars, and the domestic new energy vehicle penetration rate will exceed 35%, which will further drive the growth of demand for domestic parts.

In many sub-sectors, the substitution rate of domestic parts has increased significantly. For example, the localization rate of power batteries has exceeded 90%, and domestic manufacturers such as CATL and BYD occupy a leading position in the global market.

Although the overall localization rate of automotive-grade MCUs is still relatively low, companies such as GigaDevice and Guoxin Technology have launched self-developed products, gradually breaking the monopoly of foreign capital. In the field of materials and precision parts, although the high-end market is still dominated by foreign capital, the breakthroughs in hot-formed steel technology by domestic companies such as Baosteel and Lingyun Co., Ltd., as well as the layout of Qinchuan Machine Tools and Hengli Hydraulics in rolling functional parts, all show a strong momentum of domestic substitution.

The technical strength of domestic parts continues to improve, especially in emerging fields such as intelligent driving and humanoid robots. The localization rate of laser radar leads the world, and companies such as Hesai Technology and RoboSense have occupied more than 95% of the market share. Driven by the Horizon Journey series of domain controllers, the localization rate of domestic domain controllers is expected to reach 30% in 2025. At the same time, domestic companies such as Green Harmonic and Top Group are also focusing on the incremental market of robots and intelligent driving to accelerate the process of domestic substitution.

However, domestic substitution still faces many challenges. In the fields of high-end chips, precision components, basic materials, etc., domestic parts still rely on imports. The barriers of foreign brands in technology and supply chain have also brought certain resistance to domestic substitution. But it is these challenges that have inspired domestic companies to have greater innovation momentum.

3. Three major directions of change in the future

5G-A and AI reconstruct the industrial ecology

The commercial use of 5G-A technology in 2025 will promote the deep integration of “communication + computing + AI”. China Telecom’s 5G-A full-area coverage network has achieved millimeter-level control of drone logistics, and Huawei’s “AI-Centric 5G-A architecture” can reduce network operation and maintenance costs by 30%. AI big models will penetrate the entire chain of design, production, and after-sales. For example, Bosch uses natural language processing to optimize the efficiency of IT work order classification. Lightweight and intelligent dual main lines parallel

Lightweight technology has become the core path for car companies to reduce costs. The penetration rate of integrated die-casting process is expected to increase to 30%, and the application of carbon fiber composite materials has been extended to chassis structure. In the field of intelligence, the penetration rate of L3 autonomous driving has exceeded 20%, embodied intelligent technology has promoted the popularization of robot production lines, and the demand for smart cockpits and vehicle-road collaborative systems has exploded.

Globalization and regionalization coexist

Industry integration is accelerating, and Chinese spare parts companies are accelerating the construction of factories in Southeast Asia and Mexico, implementing “nearshore outsourcing” close to the main manufacturers. The six major industrial clusters in the Yangtze River Delta and the Pearl River Delta contribute 80% of the production capacity. The regionalized supply chain model gradually replaces the traditional globalized division of labor and enhances risk resistance. At the same time, regionalized production has become a trend to avoid trade barriers.

In 2025, China’s auto parts industry will usher in a golden period of development in the wave of new energy and intelligence, and domestic parts will move towards high-end and globalization. With the rapid development of technologies such as intelligent driving and humanoid robots, domestic parts are expected to make breakthroughs in more emerging markets. However, it is necessary to break through technical bottlenecks, optimize cost structures and deepen global layout.

Digitalization is not only a tool to cope with challenges, but also a core engine for reshaping competitiveness. Enterprises need to build a moat with “deep technology + ecological synergy + global vision”. In the future, companies with lightweight technology reserves, intelligent ecological integration capabilities and flexible supply chain management will have a competitive advantage, and the industry concentration will be further improved, moving towards a new stage of high-quality development.

Leave a Reply