The penetration rate of new energy vehicles is over half, but new energy auto repair is still in the early stages of development. The immaturity of the after-sales maintenance system has brought about the problem that consumers find it difficult and expensive to repair new energy vehicles after purchasing them.

This rapidly developing industry urgently needs a mature and complete after-sales maintenance system to support the continued growth of market share in the future.

Compared with the mature after-sales system of fuel vehicles, the density of new energy vehicle maintenance outlets is currently low, which is the direct reason why consumers complain that maintenance is difficult and the cycle is long. According to statistics from the China Automobile Maintenance Industry Association, there are about 400,000 companies related to fuel vehicle maintenance and repair in my country, while there are only 20,000 to 30,000 new energy vehicle maintenance companies.

Unlike the after-sales system of fuel vehicles, the maintenance ecology of new energy vehicles is dominated by after-sales services directly or authorized by automobile brands, and the proportion of external repair shops is still relatively small. At present, more than 90% of new energy private cars circulating on the market are still within the warranty period. Cars within the warranty period are worried that the warranty will be invalidated due to external repairs, so they will give priority to direct after-sales repairs, while vehicles out of warranty will give priority to repair shops considering the cost-effectiveness.

Jiemian News learned that the so-called expensive repairs by consumers are, on the one hand, that the owners intuitively feel that the repair price of new energy vehicles is higher than that of fuel vehicles, and on the other hand, the repair quotes from direct after-sales service are much higher than those of external repair shops, which exceeds consumers’ psychological expectations.

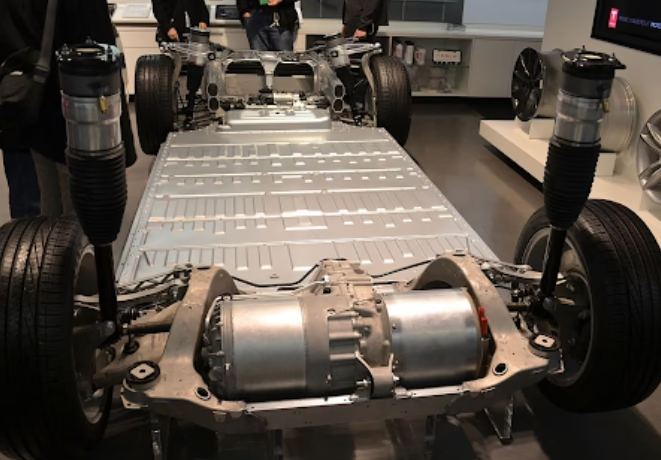

In the past, the engine and gearbox of fuel vehicles accounted for 1/3 of the total vehicle cost. Now, the cost of the three-electric system of new energy vehicles can account for half of the total vehicle cost, most of which comes from the power battery.

Once key components such as power batteries need to be repaired or replaced, the price is likely to exceed the second-hand residual value of the vehicle itself. A maintenance technician said that including the value of the battery itself and the labor cost, replacing a battery from CATL will cost tens of thousands to hundreds of thousands of yuan.

Due to the reduced maintenance demand for new energy vehicles, high store operating costs, and the fact that most direct after-sales services adopt a replacement-only approach, the final repair quotes from direct after-sales service will be 2 to 3 times more expensive than those of repair shops.

Replacing without repair is a common practice in the industry. Direct or 4S store after-sales service is more responsible for checking faults and dismantling vehicles for replacement, while external repair shops choose to repair the faulty parts.

Several new energy maintenance and after-sales practitioners told Jiemian News that, on the one hand, replacing original parts is the most efficient way for direct sales after-sales with a large number of maintenance orders. On the other hand, the safety responsibility caused by after-sales maintenance can also be borne by the OEM or parts supplier.

According to the data analysis of the national automotive electronic health archive, the main faults in the maintenance of new energy vehicles in my country are concentrated in batteries, motors and air-conditioning systems. However, in the view of many new energy maintenance practitioners, some new energy maintenance shops on the market that have transformed from traditional auto repairs do not actually have the ability to repair the above faults.

“Usually, such stores can repair or replace spare parts that do not involve key components, such as automobile chassis, covers, etc. Once problems involving key components such as power batteries are involved, there is no way to solve them.”

The “New Energy Vehicle Operation Safety Performance Inspection Procedure” officially implemented on March 1 this year clarified the national standards for the inspection items of power battery safety, drive motor safety, electronic control system safety and electrical safety of new energy vehicles, among which power batteries and electrical safety are mandatory.

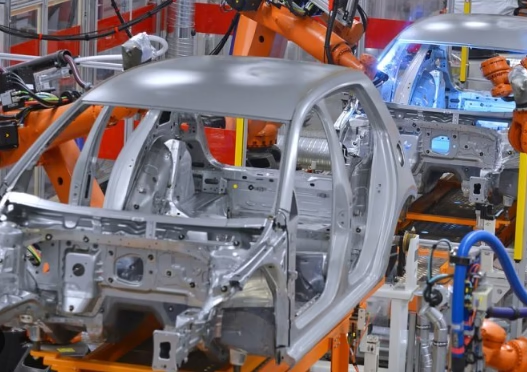

Electric vehicles have changed the structure and power mode of the entire vehicle. This technological change has also caused corresponding changes in the maintenance experience and rules formed in the past fuel vehicle era.

Zhang Kaiqiang, the person in charge of the Jiuyun New Energy Training and Enrollment, said that the standard operation process for new energy maintenance has changed. In the past, vehicle faults were judged by listening to sounds, smelling odors, and observing with eyes. However, since new energy vehicles involve electricity, maintenance personnel need to hold a low-voltage electrician certificate, be familiar with automotive electrical knowledge, and be equipped with professional insulating tools and other corresponding diagnostic equipment before they can repair them.

Because the design logic of each manufacturer’s vehicle is different, the positions of accessories, wiring harnesses, etc. are also different. There are technical barriers between different brands, and there is no experience that can cope with all situations. The degree of integration of new energy vehicles is much higher than that of fuel vehicles. The high customization of new parts such as integrated large die castings makes these parts only suitable for replacement, and the difficulty of local maintenance increases.

In addition, new energy maintenance technicians unanimously believe that mechanical hardware technical problems are relatively easy to solve, and the real difficulty lies in software problems. “After some modules are replaced, the system needs to re-import data and programming, but the OEM’s system is encrypted and requires the manufacturer’s authorization.”

A new energy 4S store after-sales manager told Jiemian News that each brand usually has strict control over special testing equipment (special inspection), and it is difficult for external repair shops to implement software updates, optimizations, and solve program vulnerabilities. 4S stores have brand authorization, and when repairing modules and other projects that require code programming, they can get the manufacturer’s support to open the code.

This means that new energy vehicles currently have very strict authorization management for their backend systems, and external repair shops may cause disputes or violate the law due to lack of authorization during repairs. Unauthorized external repair shops can only go through the 4S store channel and pay to go to the store to use its diagnostic management backend to match data.

Wang Hao, chairman of Shandong Yiwei New Energy Automobile Technology Co., Ltd., has been engaged in after-sales system services for many years. In his opinion, in addition to considerations such as intellectual property protection and technical barriers, the OEM’s backend system is not open more for security considerations, and the OEM ultimately needs to be responsible for vehicle safety.

“The vehicle control system is uniformly developed by the OEM, including the diagnostic management system. If you don’t have a reasonable identity, you can’t enter the backend for maintenance. The qualification level of the external repair shop cannot be judged. The OEM needs to consider the impact of key core content damage or data loss on vehicle safety.”

In addition, many industry insiders believe that new energy maintenance still has the problem of a single parts supply chain and insufficient maintenance talents. Unlike the diversified spare parts channels in the era of fuel vehicles, the current supply of new energy vehicle aftermarket is mainly original parts. It is difficult for external repair shops to obtain these original parts except for obtaining authorization from the OEM or parts companies.

Talent shortage is also a more urgent problem. Zhang Yanhua, president of the China Automobile Maintenance Industry Association, once said at the Automobile Hundred People Conference that there are currently less than 100,000 skilled personnel engaged in new energy vehicle maintenance in my country. The shortage of skilled personnel is mainly battery testing and maintenance, charging pile fault repair, big data analysis, assistance and autonomous driving.

Jiemian News learned that there is currently less training and education on new energy vehicle maintenance technology, and it is difficult for industry practitioners to obtain relevant skills and support. The course fees for new energy training courses on the market generally range from several thousand yuan to tens of thousands of yuan.

Wu Qiming, vice president of Zhongshan Chuanghui Automobile and Motorcycle Maintenance Training School, said that some training schools have chosen to cooperate with technical schools to train students, but it often takes several years from entering the industry to maturity.

Zhang Kaiqiang, who is engaged in new energy maintenance training, believes that new energy vehicles are still in the early stages of development, and there are few talents who master maintenance technology. At present, the development of new energy between regions is also very different, so the maintenance capabilities between regions are not balanced.

At present, the number of new energy vehicles in use has reached 31.4 million, accounting for only 8.9% of the total. From the overall market perspective, although the penetration rate of new energy vehicles is more than half, the small number of market shares, short development time, and insufficient development of the maintenance ecosystem are the root causes of the problem.

Wu Qiming believes that the existing difficulties in the industry are all interrelated. For example, the small number of maintenance outlets is directly linked to the current number of new energy vehicles in use. The only single channel for spare parts supply is original parts, which is also due to the insufficient number of original parts. Even if there are companies other than the original factory that produce replaceable parts, they will face problems such as cost, time, and low current market demand.

“It needs to form a closed loop. When the after-sales service system of new energy vehicles is as complete and mature as that of gasoline vehicles, the price will naturally come down, and finally a complete maintenance network, a sufficient supply chain of accessories, and professional talents will be formed.” In the past, a mature after-sales model was formed based on the characteristics of fuel vehicles, but new energy vehicles based on batteries need a new system to undertake, including technology, supply chain, management and other aspects. In Wang Hao’s view, the future after-sales business of new energy vehicles will be different from that of fuel vehicles. On the one hand, most of the after-sales service entities involved in the future will mainly use authorized channels, and unauthorized independent new energy repair shops may find it difficult to survive; secondly, due to the significant reduction in the failure rate of new energy vehicles, the demand for repairs and maintenance will also decrease accordingly, and the market does not need as many stores as fuel vehicles to participate. The OEMs have strong control over the authorization of original accessories and technology, and many industry insiders believe that it is justified. After all, the OEMs have invested a lot of costs in research and development and production. The more important issue is safety. New energy vehicles involving electricity and intelligence require OEMs to invest more consideration in safety. It also wants to build its own complete ecosystem in the after-sales field, so as to formulate norms and compete for more voice in the case of reduced profits in the new energy after-sales scene.

There is a view in the industry that the OEM should appropriately disclose the technology so that the repair shops in the industry can have orders to repair, so that the number of online stores in the industry and the quality of repairs will be greatly improved, which is conducive to the development of the entire new energy repair industry. There is also an opposite view that the degree of technology openness is not easy to control, and the responsibility and risk of technology openness must be equal to the responsibility and risk behind it. At present, openness is indeed beneficial to the aftermarket, but the quality risk problem after repair will ultimately be paid by the car brand.

Wang Hao said that although in the short term, the strong control of the OEM will create barriers to competition and is not conducive to the full development of the aftermarket, it is also an inevitable stage for the market ecology to mature. “Especially now that the market size is relatively small, the benefit of this kind of original factory authentic service is to solve the user’s worries. It can provide a relatively systematic service and create a model for the future after-sales system.”

This also means that in the future, after-sales companies need to follow the authorized gameplay to participate. Wang Hao believes that authorization involves exclusive technology, exclusive parts, exclusive standards, and even dedicated testing and diagnostic equipment. The prerequisite for obtaining these is to enter this authorization system and do it through a legitimate and legal identity. However, the ticket to enter the authorization system is not cheap. To obtain the authorization of the OEM, it is usually necessary to meet the requirements of the site, tools and staffing, and it is also necessary to pay authorization or franchise fees.

In the face of the wave of electrification, maintenance companies must adapt to new changes in technical difficulty, product form, service standards, etc. At the same time, if the authorization system becomes dominant in the future, it also means that independent maintenance plants with smaller scale and poorer qualifications will be eliminated from the market.

Since the development of new energy vehicles, the earlier batch of new energy vehicles launched between 2018 and 2020 have exceeded the warranty period. As the vehicle service life increases, more and more new energy vehicles will face the problem of losing warranty. New energy auto repair is calling for the rapid establishment of a system.

Why is it still expensive and difficult to repair new energy vehicles?

Leave a Reply