As a representative of emerging car companies, NIO has suffered a loss of 109.3 billion yuan in the past decade. NIO, does it still have a future?

01. NIO is not a new force but a prodigal son

The EP9 that broke the record on the Nürburgring announced the first law of NIO: its money-burning momentum is directly comparable to that of the Middle Eastern tycoons. What does it mean to lose 109.3 billion in ten years? It is equivalent to spending 61.4 million every day and burning 42,600 every minute. There are many car companies that use prodigal son as a strategy, and this is the only one that loses more than the company’s market value.

Positioning theory talks about “mental cognition”, but the user’s mind has already welded the label of “loss king” to NIO’s forehead. Tesla used Roadster to set a technical benchmark, BYD used Seagull to compete on cost-effectiveness, and Ideal accurately positioned itself in the family car scene. NIO has been playing with the brand of user companies for ten years, but the result is that it only taught the capital market to remember “The Art of Money-burning” – NIO House spends 20 million per store per year, a bottle of hand sanitizer costs 200 yuan, and each battery swap station costs 2 million. It is said to be a luxury brand experience, but it is clearly a charity event for the rich.

The user portrait is like a ghost story. Do high-end car owners pay for services or supercharging? The answer given by Weilai is to spend money on places that car owners will never go: 41.57% of users have never been to the Niuwu, and 77% of car owners admit that “I will buy Weilai even if there is no Niuwu”. When car companies regard shoe-shining services as core competitiveness, this track should be called high-end housekeeping rather than car manufacturing.

02. Multi-brand strategy is equal to self-destruction of the Great Wall

On the night when Ledao and Firefly fired at the same time, Li Bin exposed his inner anxiety: the main brand is almost unable to support itself, and he has to eat from three pots. “Wei Xiaoli” becomes “Wei Xiaodao”, which sounds like three projects of a medical beauty clinic. The first commandment of positioning theory is “focus”, but Weilai is using a shotgun to kill mosquitoes.

Let’s see how Ideal plays. All six models share the extended-range platform, and refrigerators, color TVs, and sofas run through the product line, and the label is hard enough to be used as a shield. NIO’s luxury flagship ET9 is priced at 800,000 yuan, but it turns around and pushes the 140,000 yuan Firefly. With its left hand holding high-end users and talking about “style”, and with its right hand touching the online car-hailing market and talking about “volume”, this torn positioning is like wearing a custom suit and squatting on a construction site to eat pancakes.

Ledao’s fatal injury is not the product but the identity. The shared battery swap station causes NIO owners to queue up for charging, and the warmth of the user community evaporates instantly. The same APP has promotional information from three brands, and clicking on it is like entering a Pinduoduo bargaining group. When the Alpine bag becomes the same as Taobao, the brand premium becomes a suicidal discount.

03. Technology self-entertainment becomes financial poison

The fierceness of R&D investment accounting for 20% of total revenue is tearful, but the question is what kind of barriers the money has created. The result of burning 13 billion yuan every year is: autonomous driving is left behind by Xiaopeng, and battery technology is hammered to the center of the earth by BYD. The most successful technological innovation is actually the mobile phone – although the probability of users exchanging Apple for NIO phones is about the same as finding a needle in a haystack.

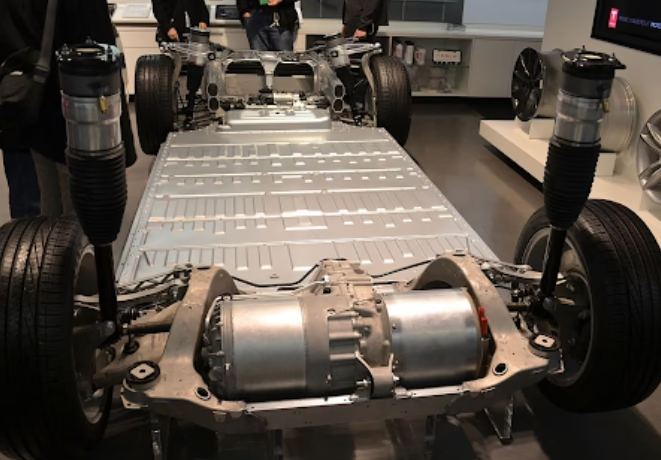

The battery swap personality is more like a self-touching performance art. 3,000 battery swap stations are like 3,000 knives stuck in the financial statements. The average daily battery swap service of 28 times fed by the annual operating fee of nearly 1.5 billion is not even enough to balance the cost. When BYD broke out that it could charge 400 kilometers in 5 minutes, Weilai’s only life-saving straw became a rope around its neck.

Misplaced technology strategy is like taking a loan for plastic surgery. Others develop their own chips to reduce costs, while Weilai uses five laser radars to decorate the facade. Others focus on “three-electric breakthroughs”, but it has to rush into the red ocean of mobile phones. Positioning theory says “cognition is greater than facts”. What users remember is not the technical content, but “Weilai’s car key is worth 5,000.”

04. Arrogant service is devouring the future

Qin Lihong said that user companies should learn from Haidilao, but they ended up learning Xu Jiayin’s car manufacturing-the profit of a five-star pomp and circumstance food stall. The cost of acquiring a single user is 60,000, which is three times more expensive than its peers. Weilai car owners jokingly call themselves golden phoenixes, but they have actually become walking money-shredding machines.

The user operation department employs overseas returnees to pour tea and clean cars. This luxury is more absurd than hiring rocket experts to light firecrackers. The essence of Haidilao-style service is to dilute costs through the “scale effect”. When each car is paying 12,000 yuan in after-sales service fees, it is no longer operating a business but buying reputation. Unfortunately, while the number of user APP downloads has skyrocketed, accounts payable have also exceeded 34.3 billion.

The Niuwu story completely exposes the strategic illusion. The 3,000-square-meter Wangfujing flagship store has been turned into a high-end shared study room, and the number of customers received each week is not as good as the sales office’s half-day traffic. Ledao Delivery Center held a birthday party for car owners and spent 80,000 yuan, but the referral rate was less than 3%. There is nothing wrong with worshipping users as gods, but the problem is that gods never bring goods and only collect incense money.

05. Overseas expeditions have become a capital graveyard

When He Xiaopeng cut off European business and focused on selling cars, Weilai was still building a global design center in Munich. Positioning theory emphasizes “attacking the heart first”, but Li Bin insisted on fighting a war of attrition on the territory of German tanks. The European sales of 2,138 vehicles for the whole year did not even reach the fraction of BBA.

Overseas strategy is a mixture of naivety and arrogance. The direct sales model and heavy asset investment are like young nouveau riche showing off their wealth. Building a showroom is more difficult than opening a Volkswagen store. The approval period for building a local battery swap station is as long as ten months. This is not market development, but giving year-end bonuses to the supervision company. The headlights of the Firefly Trio were sprayed to look like Erlang Shen, and the EU’s anti-subsidy stick has been raised to the air.

The essence of globalization is localization, but NIO insists on going to war with fundamentalism. Tesla’s Berlin factory cut costs and reduced tariffs, but it insisted on a high-price strategy to confront local brands. When Wang Chuanfu swept Southeast Asia with the seal, the NIO R&D Center left in Munich was like a ancestral temple of the previous dynasty.

06. The only way to survive

Don’t talk to investors about technology layout, the capital market has already voted by slashing the stock price in half. Don’t talk to car owners about poetry and distant places, the 41.9 billion on the cash flow statement can only support 12 months. There are only three things you can do to survive in 2025: cut off delusions, lock in positioning, and reduce costs to the bone.

The first cut must be made to blindly high-end. The 900V architecture and wire-controlled steering of ET9 are indeed amazing, but they cannot support the 800,000 price ceiling. Ledao must cut off the fancy configuration and go for volume models, and learn from Xiaopeng P7+ to engrave cost performance into its DNA. If Firefly continues to pursue the design pioneer set, it is better to directly transform into an old man Le OEM factory.

The battery swap station should be closed. Users do not need religious services but real battery life. The core city stations are retained as image projects, and the suburbs are fully converted to cooperative fast charging. CATL’s investment of 2.5 billion is not given in vain. The correct solution is to package the battery swap into an energy storage solution and sell it to the State Grid.

R&D must be strategically slimmed down. Stop the mobile phone business to stop losses, and the chip team will switch to outsourced development services. Autonomous driving should be embraced, and the parallel operation of two systems is a pure waste of resources. Jia Yueting’s fate tells everyone: only the founder of a semi-finished product dares to go all in on all tracks.

User operations must return to the essence of business. Disband the overseas prestigious school car cleaning group, and transform Niuwu into a city showroom and coffee shop to make a profit. The owner’s birthday party budget was reduced to 50 yuan per person, and two parties a week are enough to maintain decency. Service is not a luxury but a value-added item. If you want to make money at the top of the smile curve, you must first stand on the step of “economy of scale”.

Multi-brand strategy must reshape boundaries and position each independently. Weilai’s main brand only retains two flagships to take the high-priced limited route, Ledao focuses on the 200,000-300,000 mainstream market to copy Xiaomi SU7’s play, and Firefly changes to a sub-brand as a pure electric version of Wuling Hongguang. The three brands share the same platform production, and use 80% of the parts commonality rate to squeeze the supply chain.

Li Bin should learn from Lei Jun to be a product tyrant. I heard that the new ES6 will cut the laser radar to save 20,000, this is really enlightened. Wang Chuanfu can achieve the ultimate in vertical integration, and Li Bin must engrave cost control into his bones. The supplier’s payment period is compressed from half a year to three months, which can immediately activate tens of billions of cash flow.

07. Time is running out for China’s Steve Jobs

When He Xiaopeng said “Only those who survive are qualified to write history”, and when Li Xiang deleted posts on Weibo, the new energy battlefield no longer believed in tears. What Weilai wants is not only to stop the bleeding decisively, but also to reconstruct the entire business logic. The final warning of positioning theory is deafening: either differentiation or extinction.

If you choose to be a high-end electric car Porsche, you must ruthlessly cut off all low-end businesses, and the service premium must make the rich willing to pay for it. If you want to be China’s Tesla, please immediately stop production of the ES series and turn to the ModelY hinterland. The most dangerous thing is to swing between the two ends, neither letting go of the shelf nor wanting to make quick money.

The battery swap story has come to the end. Either find a national team to take over the infrastructure burden, or make a decisive move and turn to supercharging. It should be noted that 600 battery swap stations are enough to establish a persona, and 5,000 can only pile up tombstones. Self-developed chips are worth keeping, provided that they are supplied to the entire industry to dilute the cost.

Today, the people who criticize NIO the most are often car owners, who are afraid that they will not be able to pay for the maintenance of charging stations tomorrow. Li Bin said that he would make a profit in the fourth quarter. If he fails to make the payment again, he will either repeat the year or drop out of school. The ticket to the new energy table is not money but efficiency. When capital patience is exhausted, no matter how touching the story is, it cannot beat the due accounts payable.

Finally, let me tell you a harsh truth: companies that can spoil users into giant babies are worthy of respect, but the business world only rewards adults who can make money. NIO’s future is not in PPT but in the production line, not in the cow house but in the 4S store, not in Li Bin’s smile but in the financial statements. The gamble has been opened, the chips have bottomed out, it’s time to let idealism go and invite realism to come on stage!

NIO, does it still have a future? Its money-burning strategy has its positive side, but it is also accompanied by many potential risks. In the future, NIO needs to strike a balance between technological innovation, market expansion and cost control to cope with market competition and profitability.

Leave a Reply