Japan’s KeiCars are the cutest cars on the road. Look at them – can you imagine a more perfect little people mover? Clearly not, and I couldn’t agree more. Their perfection is well known, Japan knows it, and China has apparently noticed – because electric car giant BYD has set its sights on the KeiCar market.

BYD Japan head Atsushi Fukuda said he had spotted an opportunity for the brand to tap into Japan’s $18 billion KeiCar market, according to the Financial Times. If BYD’s efforts in other global markets are anything to go by, the automaker is likely not just testing the waters but planning an all-out offensive.

BYD aims to break the decades-long stranglehold of Japanese automakers like Toyota, Honda and Nissan on the market. In an interview, BYD Japan president Atsushi Fukuda said there was room for low-cost micro-electric cars the size of “Mr Bean’s Austin Mini Cooper” as high taxes push up traditional fuel prices and gas stations disappear rapidly in Japan’s dwindling rural areas.

“Light cars are highly compatible with the Japanese lifestyle,” he said. “If consumers fully understand the economic rationale, they will be willing to buy light cars outside of existing mainstream brands.”

Chinese automakers have already seized market share in Southeast Asia, a traditional market for Japanese automakers, and the planned light car model will be one of BYD’s first models designed specifically for overseas markets and not sold in China first. However, key details such as range, price and appearance have not yet been announced.

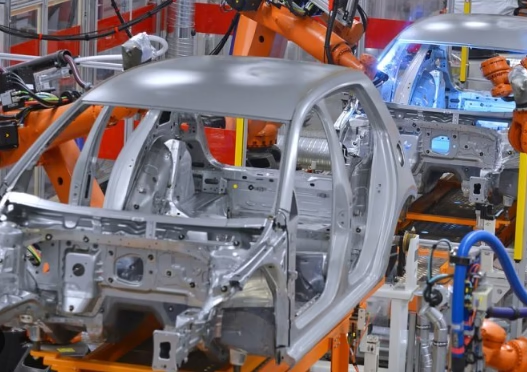

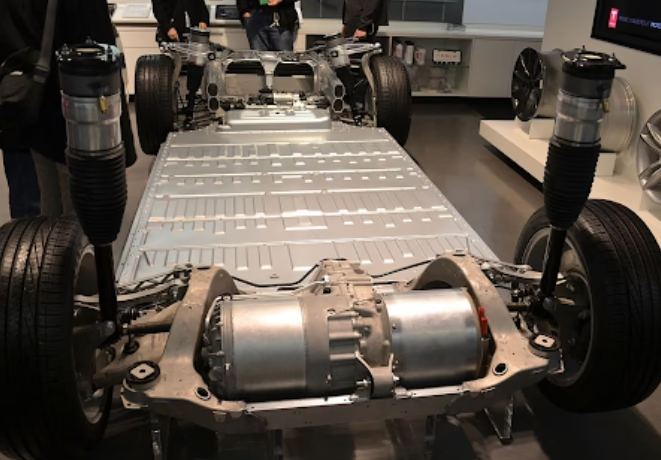

BYD has been able to penetrate other markets around the world with innovative products and extremely competitive prices. Thanks to rapid vertical integration and government subsidies, the automaker has quickly transformed from an early imitation of the Mercedes-Benz W209SL-class model to one of the world’s most cost-effective, technologically rich and amazing car manufacturers.

But innovation may not bring instant success, especially in Japan’s “cutest car” segment. If BYD wants to surpass brands such as Honda, Nissan, Suzuki and Toyota, it needs to overcome two major problems:

First, similar to Chinese consumers’ preference for local brands, Japanese car buyers are extremely loyal to local brands. According to the Financial Times, foreign automakers account for less than 6% of the Japanese car market. BYD has been selling cars in Japan since 2013, and delivered just 2,221 in the first quarter of 2025—and it’s not because of a lack of capacity.

Second, Japan isn’t really an “EV-first” country. While some other Asia-Pacific auto markets have embraced EVs, fewer than 60,000 EVs were sold in Japan in 2024, accounting for less than 2% of all auto sales for the year.

This means BYD is not only entering a market where local consumers are resistant to foreign cars, but also gaining a foothold in a niche that has limited sales of its own. BYD’s only advantage in this particular market is that there is less competition—in fact, its only direct electric competitor is the Nissan Sakura, which costs about $18,100 (2.6 million yen), and BYD’s planned model is said to be cheaper than the BYD Dolphin, which costs about $20,000.

BYD is reportedly planning to launch the electric light vehicle in the second half of 2026. Fukuda said that if the model is not popular in the Japanese market, BYD may push it to overseas markets such as Europe and India to see if consumers in other regions are interested in “a shoebox-sized car”—and “I would be interested,” he added.

Leave a Reply