The sales ranking of new forces in May is really a mixed bag. Some are happy and some are sad. Some are just rushing to finish, while others are cut off. The key is to see who can gain a foothold in this cruel market.

01. Leapmotor: The road to the “Triple Crown” of price butcher

Leapmotor delivered 45,067 units this month, a year-on-year increase of 148%. Look at this posture. It has dominated the list for three consecutive months, and it really holds the title of “Triple Crown” firmly.

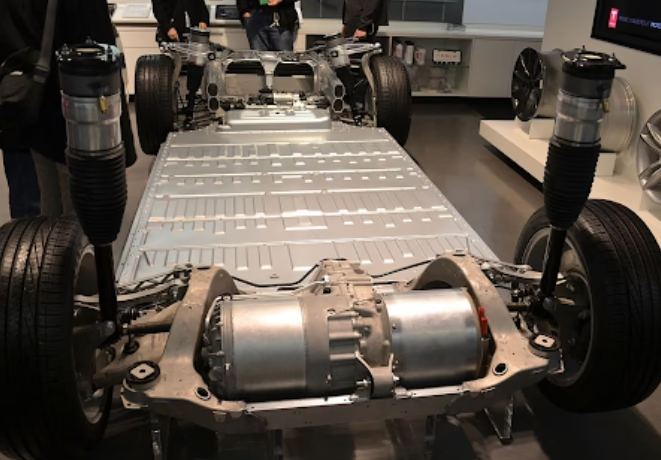

Frankly speaking, Leapmotor can achieve today’s results by relying on the “half-price ideal” strategy. People have stuffed high-end configurations such as 800V high-voltage platform and laser radar into 100,000 yuan-level models. This operation really makes those luxury brands feel cold.

My friend Lao Zhang just bought Leapmotor C10 two months ago and spent a little over 150,000. If you buy the same configuration from other brands, you have to start at least 300,000. What do you think if this is not the law of true fragrance? Now Zhang always tells everyone: If I had known that new energy vehicles were so attractive, fuel vehicles would have been a hot potato.

What’s more amazing is that Leapmotor’s revenue in the first quarter exceeded 10 billion yuan, and its gross profit margin reached a record high of 14.9%. It seems that they can not only sell cars, but also make money. Export sales are also the first among new forces, with the number of 17,200 units, which means that they are going to bloom in all aspects.

02. Xiaomi: Lei Jun’s dream of making cars has come true

Xiaomi delivered 28,013 vehicles in May, ranking fifth. You know, this is the result achieved when Xiaomi Auto only has one model, SU7. Some friends may ask: Is this considered a success?

My answer is: It is absolutely stable!

Lei Jun’s flag set at the beginning now seems to be no bragging. From January to May, Xiaomi Auto’s cumulative sales were close to 130,000 vehicles. For a new brand and a single model, this result can really be described as “against the sky”.

But to be honest, Xiaomi’s biggest problem now is not that it can’t sell, but that its production capacity can’t keep up. I have a friend who placed an order in March and is still waiting in line for the car. I am so anxious… I can only watch the orders line up to the horizon, but I can’t get the car.

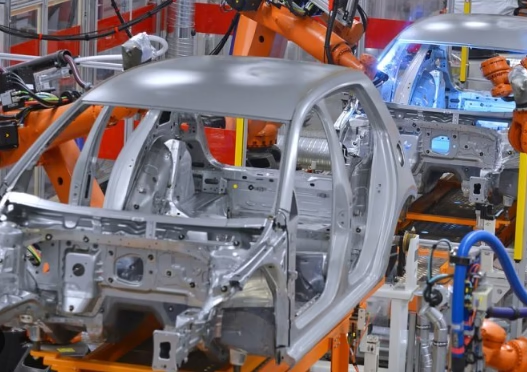

The good news is that the second phase of the Xiaomi factory project is about to be put into production, and it is expected to start construction in July-August. When the production capacity is increased, Xiaomi’s sales volume is expected to rise. In addition, YU7 is about to be launched. After this wave of operations, Xiaomi’s position in the new forces will be more stable.

03. Weilai: It’s a bit too much to say that it crashed

Weilai delivered a total of 23,231 units in May, a year-on-year increase of 13.1%. Seeing the word “flash crash” in the title, it is estimated that many Weilai owners will not accept it.

To be honest, it did drop by 2.8% month-on-month, but it was still a positive year-on-year growth. This is not a flash crash, at most it is a small fluctuation. Maybe everyone’s expectations for Weilai are too high, and they start to worry when they see a slight decline.

In fact, after a careful analysis, Weilai’s current strategy is still quite clear: the multi-brand strategy is in full bloom. NIO sold 13,270 units, Ledao sold 6,281 units, and Firefly delivered 3,680 units in the first month. This layout is obviously intended to cover a wider market range.

I think the biggest problem NIO is facing now is not the lack of product strength, but the fierce competition. Leapmotor is reaping the benefits in the low-end market, Xiaomi is rising strongly in the mid-end market, and Ideal has deep roots in the family car market. NIO really needs more efforts to regain its position as the sales champion.

04. Other players: each showing their magical powers

In this month’s list, Hongmeng Zhixing ranked second with 44,454 units, and Ideal ranked third with 40,856 units. Huawei’s technical support is indeed not covered, and the performance of the Askjie series has been very stable.

Although Ideal ranked third, its growth momentum is still very strong, with a year-on-year increase of 16.7% and a month-on-month increase of 20.38%. The positioning of family cars really captured the hearts of many parents.

Xpeng sold 33,525 units this month, a year-on-year increase of 230%. Although it has declined slightly month-on-month, it has exceeded 30,000 for 7 consecutive months, which is a pretty good result.

The market is getting more and more cruel

After reading this May list, my biggest feeling is that the new energy vehicle market is really getting more and more competitive day by day.

Leapmotor has made its way through the market with cost-effectiveness, Xiaomi has quickly risen to the top with its brand power, and Weilai has insisted on its own route in the high-end market. Each company has its own trump card, but they also face different challenges.

To me, consumers are the biggest winners. The more competitive the car companies are, the cheaper the cars we buy, the higher the configuration, and the better the service. This kind of healthy competition is really something we want.

As for those friends who are still waiting and watching, I want to say: act when it’s time. Now is really a good time to buy new energy vehicles at the bottom. If you wait any longer, you may miss another good opportunity.

Leave a Reply