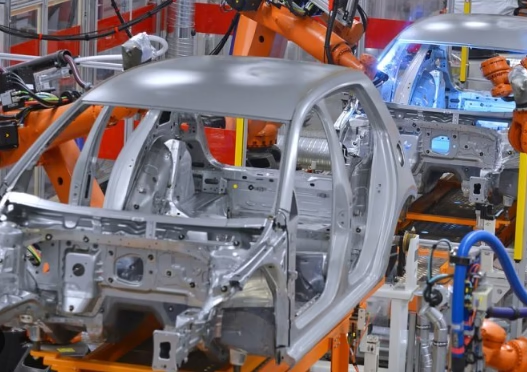

Multinational auto parts giants are actively competing for Chinese customers! Constrained by the overall decline in automobile production and sales in the European and American markets and the high investment expenditures for electrification transformation, multinational auto parts companies, whose operating performance was collectively under pressure last year, need orders from Chinese auto customers more than ever before.

At this year’s Shanghai Auto Show, multinational auto parts giants are enthusiastic about participating in the exhibition. Their key products are mostly innovative achievements developed for the Chinese new energy vehicle market, involving the most popular technology application areas such as wire-controlled steering, power systems, assisted driving systems, and smart cockpits. They are eager to take this opportunity to gain the favor of Chinese vehicle manufacturers.

A senior executive of a multinational auto parts company revealed to Jiemian News that his main task at this auto show is to receive domestic vehicle manufacturers and invite them to the booth to learn about the results developed by the Chinese team. During the interview, a domestic leading traditional enterprise visited, so the parts company temporarily restricted booth visits and media reception.

In terms of the scale of the exhibition, the exhibition area of the automotive technology and supply chain exhibition area of this year’s auto show has increased from 30,000 square meters in the previous session to about 100,000 square meters, accounting for one-third of the entire exhibition. More than half of the world’s top 100 parts suppliers are present, and internationally renowned suppliers such as Intel, Mobileye and Haosi Power are participating in the exhibition for the first time.

According to incomplete statistics from Jiemian News, the number of press conferences held by multinational parts companies this session is more than double that of the previous session. The top leaders of most companies’ global headquarters came to the platform to show their determination to “be in China, for China” and their subsequent localization investment plans.

Winning Chinese customers means obtaining gold certification in the most competitive market. More than one senior executive of multinational parts companies interviewed by Jiemian News expressed the importance of China as the world’s largest and most innovative market. Tenneco CEO Jim Voss believes that if you want to succeed in the global market, you must first succeed in China and must succeed in the Chinese market.

A supply chain person of new car-making forces who often deals with parts companies feels the transformation of multinational giants. He told Jiemian News that in the past, if you want to get the support of multinational first-tier suppliers, there will be various cooperation clauses, but now that the fixed-point demand has just been released, they will take the initiative to discuss cooperation, “After all, there are too many choices in the market now.”

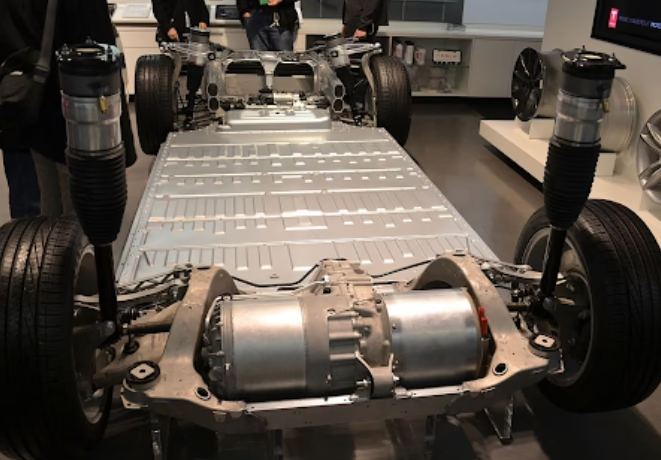

The multinational auto parts giants that once rested their heads are experiencing similar transformation difficulties as multinational manufacturers. Against the backdrop of a shrinking base of fuel vehicles, they need to find a second growth curve for the future. However, the transition to electrification requires a large amount of upfront investment, which cannot bring enough benefits to parts manufacturers to balance expenditures.

At the same time, Gong Min, head of UBS China’s automotive industry research, told Jiemian News that in the wave of electrification and intelligent transformation, a group of emerging Chinese suppliers have grown from nothing to something, from small to large, and have become the leaders of the latest technology. For example, in the field of autonomous driving, Chinese automakers have shifted their preference from multinational parts giants to a group of newly emerging Chinese companies.

A traditional large-scale new energy sub-brand R&D personnel told Jiemian News that at present, in addition to core components such as chips with technical barriers, there are basically domestic alternative options. Another employee of a new car-making force revealed that he is more concerned about the technical applications of domestic intelligent parts companies at this auto show, and multinational parts suppliers are not the first choice.

Chinese suppliers such as Horizon, Momenta, and Hesai have opened up new incremental markets and taken away market share from traditional overseas suppliers with lower costs, better performance, and better after-sales services. Momenta released information at this year’s auto show that the number of models successfully delivered for mass production has soared from 1 in the initial stage of 2022 to 130 at present, and its vehicle manufacturer customers include SAIC Volkswagen, Honda China, SAIC Audi, etc.

This year, domestic suppliers have also become the main force of the Shanghai Auto Show. Yuanrong Qixing, Autolink, Core Engine Technology, Momenta, etc. are all participating in the exhibition for the first time. Interface News noted that Huawei’s Intelligent Automotive Solutions BU and Huawei Digital Energy booths are the most lively parts booths, and there are many visitors from traditional multinational companies such as BMW.

Roland Berger Global Partner Wu Zhao was interviewed by Interface News and pointed out that the biggest problem for multinational automotive parts companies in China is that the product development speed caused by the entire management system mechanism is not fast enough, which is difficult to match the rhythm requirements of some Chinese customers. In contrast, Chinese local suppliers are more flexible and can adopt different business models to cooperate with car companies in deep joint development, so as to quickly implement forward-looking technologies in a more agile way.

Especially in the field of assisted driving and cockpit, suppliers are required to intervene at the beginning and jointly define product requirements with vehicle manufacturers. Some Chinese manufacturers require suppliers to provide white box solutions that can be deeply independently developed, rather than the traditional closed black box delivery model.

Mobileye, an Israeli autonomous driving chip manufacturer, participated in the Shanghai Auto Show for the first time this year and exhibited a number of assisted driving system solutions. However, due to the strong coupling between Mobileye’s self-developed autonomous driving algorithm and chip hardware architecture, it can only sell black box solutions that integrate software and hardware to automobile companies.

A Mobileye insider told Jiemian News that Mobileye has a 200-person R&D team in Jiading, Shanghai, which is the largest R&D center outside the Israeli headquarters. However, compared with local Chinese autonomous driving suppliers, Mobileye is at a relative disadvantage in terms of product development response speed and cooperation requirements. Many after-sales software problems can only be solved across time zones by the Israeli headquarters.

Zeekr is Mobileye’s most closely tied customer, but under the pressure of market competition, Zeekr also cut into Nvidia’s Orin chip last year and developed its own assisted driving algorithm based on it. At the Shanghai Auto Show, Mobileye’s booth was small and relatively deserted.

Affected by the industry’s price war, some Chinese suppliers sacrificed profits for market share. Ma Chuan, president of Freya China, told Jiemian News that some suppliers engaged in price wars and snatched orders, which not only put pressure on foreign companies, but also caused the entire industry to fall into involution. However, the transmission of this cost pressure will also force each company to strengthen localized innovation and promote industry development to a certain extent.

Wu Zhao pointed out to Jiemian News that cooperation with independent brand automobile companies is the only way for multinational parts companies to succeed in their domestic business. In addition to accelerating product research and development, further localization of the supply chain will drive cost reduction in the operating system. At the same time, global R&D innovation also needs to be more dominated by the Chinese market.

Freya has more than 30,000 employees and 67 factories in China, and has established 27 R&D centers. Ma Chuan believes that the strength of local R&D capabilities will directly affect the quality of China’s business. At the Shanghai Auto Show, Freya brought a total of 9 global first-time products, many of which were developed by the Chinese R&D team and sold globally.

Nathan Bowen, executive vice president of Tenneco Group, told Jiemian News and other media that Tenneco’s organizational structure is based on regional applications, and 99% of decisions can be made locally. Even in core links such as production, cost and personnel decisions, the Chinese team does not need to wait for responses from the European and American headquarters.

Some parts companies are actively working with local Chinese suppliers. Visteon, an automotive electronics supplier, has reached a cooperation with Volcano Engine, a cloud service platform under Chinese technology company ByteDance, and the two parties have released the next generation of smart cockpit solutions based on AI large models; Bosch and Horizon also signed a strategic cooperation memorandum during the auto show to jointly develop assisted driving systems.

Gong Min pointed out to Jiemian News that these companies’ next investment will be less in the production capacity part, and more in localized R&D, gradually changing from “hands” to “brains” investment.

It is worth mentioning that in order to meet the stringent requirements of Chinese manufacturers for cost control, multinational auto parts giants are still making every effort to promote cost reduction. Li Xiang, president of Tenneco Asia Pacific, said that since the year before last, Tenneco has begun to reduce the cost of the entire value chain to the most optimized level in order to adapt to the competition in cost and value in China.

An insider of a domestic new energy brand revealed to Jiemian News that due to the limited energy of the self-developed autonomous driving team, the company is currently considering the mid-level assisted driving technology solutions provided by multinational auto parts companies and has entered the project evaluation period.

“After internal calculations, it was found that multinational suppliers can already reduce costs, and it will also help the models go global.”

Multinational auto parts giants have begun to actively compete for Chinese customers! Large multinational parts suppliers still hold the three trump cards of scale advantages, global layout and reliable safety. Whether they can win more customers in the Chinese market will also depend on how to play these three cards well.

Leave a Reply