Since the 1990s, Chinese motorcycle companies have sensed opportunities in the Southeast Asian market and have attacked the market with a low-price strategy. Vietnam has become a key battlefield, with 45 million vehicles in stock, attracting domestic manufacturers. During the craziest period of the price war, the profit of a motorcycle was reduced to only a few dollars. In order to maintain a meager profit, some companies began to lower the standards of spare parts: the life of the carburetor was shortened from two years to half a year, the anti-skid pattern of the tire became shallower, and the thickness of the frame steel was reduced. Consumers soon discovered that Chinese motorcycles rusted faster, had more failures, and consumed more fuel.

The cost of quality collapse is devastating. Vietnamese consumers have re-embraced the expensive but durable Japanese motorcycles, and China’s market share has plummeted to less than 5%. The more far-reaching impact lies in the brand image-in emerging markets such as Latin America and Africa, “Chinese motorcycles” once became synonymous with inferior products.

It is interesting to note that the Chinese motorcycle industry has been reborn with difficulty after setbacks. In 2024, exports will reach 36.76 million units, accounting for 55% of the global total sales. But this recovery took nearly two decades, and the cost is heavy.

Danger signal: a precursor to the “history repeat” of new energy vehicles

The current trajectory of new energy vehicles going overseas is surprisingly similar to that of motorcycles:

Price involution and spillover: Chinese car companies have already competed to offer discounts in the Middle East and Latin American markets, and a certain model has reduced its price by 23% in Chile in half a year.

Clustering homogeneous markets: 80% of new energy vehicle exports will be concentrated in 10 countries in 2024, and the channel service capabilities in emerging markets are weak.

After-sales shortcomings are highlighted: Southeast Asian users report that it takes 45 days to replace electric vehicle batteries, and the density of maintenance outlets is less than 1/3 of that of fuel vehicles.

What is more worrying is that signs of vicious competition have emerged. In order to seize market share in South America, a certain car company launched a “reduced version” of electric vehicles and cancelled the battery thermal management system, resulting in a 30% acceleration of battery decay in high temperature areas. These behaviors are exactly the same as the path of motorcycles sacrificing quality to reduce prices.

The way out: from “single-handedly” to “group operations”

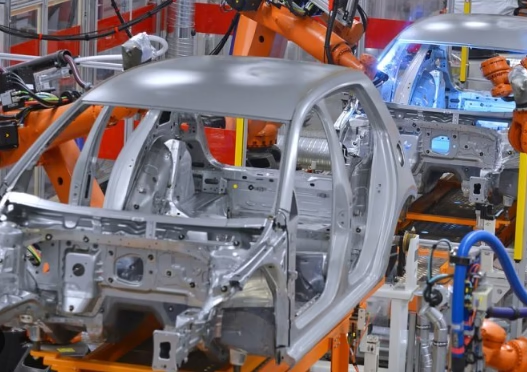

Historical lessons are giving rise to change. On June 7, 2025, three provinces and one city in the Yangtze River Delta signed an agreement to establish a new energy vehicle export base. The Yangtze River Delta, which accounts for 40% of the country’s output, is for the first time facing the global market as a “group army”. Its innovative model directly hits the pain points:

Table: Core functions of the Yangtze River Delta new energy vehicle export base

| Functional modules | Specific measures | Solve the pain points |

| Global Supply Chain Services | Introduced business representatives from 150 countries and established an overseas “general agent” system | Avoid duplication of channels |

| Standardized Output | Promote mutual recognition of battery/charging standards | Reduce compliance costs |

| Full cycle service | Co-build overseas warehouses + maintenance centers + charging networks | Make up for the shortcomings of after-sales service |

| Financial empowerment | Unified export credit insurance and cross-border settlement support | Protect against exchange rate risks |

This platform further promotes the closed loop of the industrial chain of “Shanghai R&D-Yangtze River Delta Manufacturing-Global Delivery”. Jiangsu’s batteries, Zhejiang’s electronic controls, and Anhui’s complete vehicles are integrated through bases to establish the first Central Asian cooperation center in Kazakhstan, radiating the markets of 23 countries.

CFMOTO’s transformation in Europe confirms the feasibility of systematic overseas expansion. After terminating its distribution cooperation with KTM in 2025, it will: build direct experience stores in Milan and Munich

acquire French brand GOES to achieve dual-brand operation

establish 20 4S service centers to provide 24-hour rescue

make European electric vehicle sales grow by 200% against the trend.

Value upgrade: three pillars beyond “low-price dumping”

Simply avoiding historical mistakes is not enough, new energy vehicles need to build differentiated competitiveness:

1. Technology binding standards

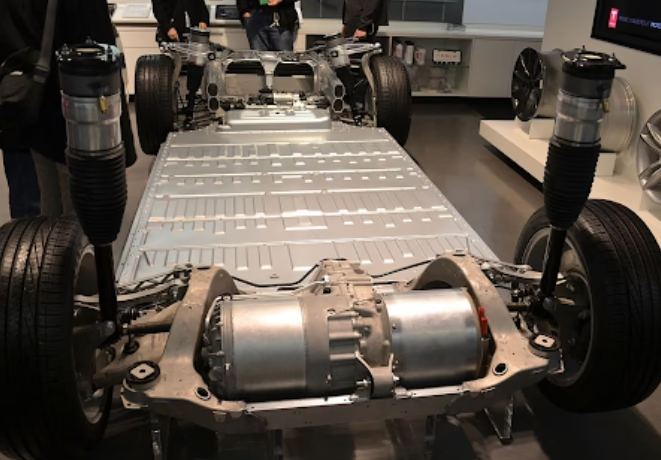

Under the RCEP framework, China and ASEAN jointly build an electric vehicle safety certification mutual recognition system, and the localization rate of Indonesia’s Wuling factory reaches 40%, driving the upgrading of its domestic battery industry chain. By converting technological advantages into standard discourse power, the battery modules produced by Chinese battery companies (such as Guoxuan High-tech) in their Thai factories have been included in the ASEAN safety standard template.

2. Green value spillover

When Cambodia bundled the photovoltaic power stations built with China’s assistance and BYD electric vehicles to build a “clean energy + electric transportation” system solution, China’s new energy exports have surpassed simple commodity trade and upgraded to the output of a low-carbon development model.

3. Cultural integration and innovation

ZEEHO electric motorcycles launched a “customizable car system” in Europe, supporting access to local mainstream social software and operating user communities through riding clubs. This cultural adaptation has enabled it to grow rapidly despite its price of 6,000 euros in Germany.

Table: Comparison of motorcycle and new energy vehicle export strategies

| Dimensions | Traditional motorcycle exports | New energy vehicles going overseas | Upgrade Key |

| Core of competition | Low price | Technology + Ecosystem | Value upgrade |

| Marketing Strategy | Each for his own | Group sailing | Resource Integration |

| Brand Building | Mainly OEM | Independent brand building | Long-term investment |

| Service Network | Scattered maintenance points | 4S service center + fast charging network | User Experience |

The painful lesson that Chinese motorcycles took ten years to conquer the Vietnamese market and lost it in two years has carved a warning monument for new energy vehicles to go overseas. When the “joint fleet” of the Yangtze River Delta sets sail, when RCEP member countries jointly build a charging network, and when Chunfeng Power builds its own service standards in Europe, we see not only the upgrade of business strategies, but also the cognitive leap from “making quick money” to “shaping value”.

Can China’s new energy vehicles break out of the cycle law? The answer is not in customs export data, but in the photovoltaic charging stations on the African grasslands, in the 10-minute fast charging piles on the streets of Southeast Asia, and in the exclamations of European consumers for China’s smart cockpits. When the industry regards every vehicle as the starting point of the full life cycle service rather than the end point, the tragedy of motorcycles will eventually become nutrients for the future.

Leave a Reply