China’s car export enthusiasm to Russia has cooled rapidly.

According to data from the China Passenger Car Association, from January to May 2025, China exported 153,000 complete vehicles to Russia, a year-on-year plunge of 59%. The export of fuel vehicles, which is the main component, fell by 58% year-on-year to 135,000 vehicles.

In contrast, new energy vehicles performed well, increasing by 245% year-on-year to 7,000 vehicles, but their total volume is small and cannot change the overall trend of declining car exports to Russia.

In 2023 and 2024, Russia became China’s largest automobile export market for two consecutive years, and the export volume of complete vehicles in 2024 reached 1.158 million vehicles, accounting for 20% of the total exports. However, since 2025, the export volume and sales volume of Chinese auto companies to Russia have continued to decline.

Russia’s policy measures such as raising the scrap tax on imported cars and cracking down on parallel imports have greatly impacted the price advantage of Chinese auto companies in the local area. The cold consumption in its domestic market due to high inflation is also an important driving force for the sluggish auto market. Major exporters to Russia, including Chery, Great Wall, and Geely, have all been hit to varying degrees, with low-priced models being the most affected.

Faced with local market fluctuations, Chinese automakers have increased their risk awareness. In its prospectus in February this year, Chery said it would reduce sales in Russia and reduce its dependence on the local market.

Since the beginning of this year, the decline in sales of Chinese automakers in Russia has been lower than the decline in exports to Russia, which means that Chinese automakers are deliberately reducing their stockpiling in the local Russian market. From January to May 2025, the number of cars exported by China to Russia fell by 59% year-on-year, while the cumulative sales in the same period were 500,000 vehicles, a year-on-year decrease of 28%, far lower than the decline in exports. “Chinese automakers in the Russian market have improved their risk prevention awareness,” said Cui Dongshu, secretary-general of the China Passenger Car Association.

01 Fuel vehicle exports fell by nearly 60%

Unlike export markets such as the Middle East and Europe, fuel vehicles are the absolute majority of China’s exports to Russia and Central Asia (CIS countries). According to data released by the China Passenger Car Association, China exported a total of 1.634 million vehicles to the CIS countries in 2024, of which 1.434 million were gasoline and diesel vehicles, accounting for 88%.

Since 2025, automobile exports to Russia have continued to decline, and the main reason is the rapid decline in fuel vehicle exports. From January to May this year, a total of 135,000 conventional fuel passenger cars were exported to Russia, a year-on-year decrease of 58%. Affected by this, the total volume of automobile exports to Russia decreased by 59% year-on-year to 153,000 vehicles.

The most direct reason for the decline in fuel vehicle exports is that Russia has raised the scrap tax on imported cars. According to reports, on October 1, 2024, Russia will significantly increase the scrap tax on imported cars by 70%-85%, and on January 1, 2025, it will increase it again by 10%-20%, and announced that it will increase it every year until 2030.

The scrap tax on cars is a one-time environmental protection fee paid by Russia at customs clearance in accordance with vehicle engine emission standards. The tax is calculated based on the displacement of the car. According to reports, taking imported cars with an engine capacity of 1L-2L as an example, this year’s scrap tax fee is 50,000 yuan, which is more than twice the 22,000 yuan before October 2024. The increase in the scrap tax on cars has led to a 10%-15% increase in the price of imported cars, and high-end models will face a higher increase.

“In the context of the current lack of competitiveness of the Russian automobile industry and the structural shortage of supply, it is necessary to judge the changes in the situation in advance and prevent possible related policy risks in the future in advance. Safety comes first.” Regarding the changes in exports to Russia this year, Cui Dongshu, secretary-general of the China Passenger Car Association, said so.

The impact of the tax increase falls relatively evenly on car companies. From January to May this year, the top three car companies with the highest sales in Russia, Chery, Great Wall and Geely, saw sales decrease by 23%, 21% and 37% year-on-year respectively.

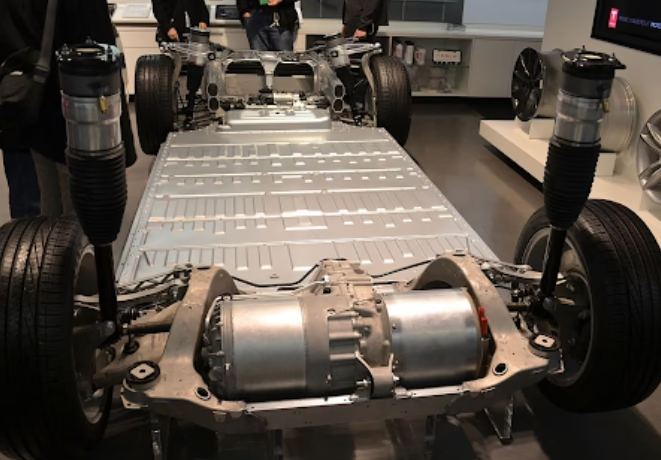

Compared with fuel vehicles, the export performance of new energy vehicles is much better. In the first five months of 2025, the total export of new energy vehicles to Russia reached 7,000 units, a year-on-year increase of 245%. Although the scale is small, the growth rate is very impressive. BYD, Great Wall’s Ora and other brands have grown significantly.

02 Channels are blocked, taxes and fees are rising, and car sellers face multiple pressures

The increase in car scrapping tax is only one of the obvious taxes. The blow to parallel export channels is another major reason for the decline in exports.

This needs to start from 2022, when Chinese automakers’ exports to Russia began to explode.

The Russian-Ukrainian conflict broke out in 2022, and the Russian passenger car market was left with a huge gap due to the withdrawal of foreign automakers such as Japanese, Korean, and European automakers, giving Chinese automakers an opportunity to quickly enter. In 2023, China’s auto exports to Russia soared 340% year-on-year, accounting for 45% of the local imported car market.

In 2024, China’s auto exports to Russia continued to grow by 30.5% year-on-year, reaching 1.158 million vehicles. Among these vehicles, there are many “zero-kilometer used cars” that are parallel exported to Russia.

The so-called parallel export refers to the purchase of new cars from China by traders without the authorization of the automobile brand factory, and the sale to Russia through third countries such as Kazakhstan in the name of second-hand cars.

Chinese cars can of course be exported directly to Russia, but they will face high tax barriers. After the outbreak of the Russian-Ukrainian conflict in 2022, some dealers found a way to bypass the Eurasian Economic Union and avoid taxes through re-export trade.

According to the relevant regulations of the Eurasian Economic Union, as long as the car is legally exported to any country in the union, it can be registered and used within the union. The union includes five countries: Russia, Belarus, Kazakhstan, Kyrgyzstan and Armenia.

Starting from October 1, 2023, Russia adjusted its parallel import policy. Chinese brand cars including Chery, Changan, Geely, GAC, etc. must be imported by official dealers authorized by the manufacturer and obtained OTTS certificates. But some brands still export through this means.

This policy shortcut was completely closed by Russia in April 2024. After that, cars entering the Russian market from the alliance can only be put on the road after paying the difference in local taxes and fees. “Zero-kilometer used cars” that have lost their price advantage have begun to show the side effects of wild growth: due to the lack of sales channels, quality assurance and after-sales service have become problems that have to be faced in the later stage, which in turn affects the sales performance of car companies in the local area.

Taking the new energy vehicles that have performed well this year as an example, from January to May 2025, Seres’ sales in Russia exceeded 800 units, a year-on-year increase of 110%, while Ideal Auto’s sales fell sharply by 62%.

This is closely related to the sales strategies of the two car companies. In January 2024, Seres announced a partnership with Russian dealer MB RUS JSC, which exclusively sells the M5, M7 and M9 in Russia. According to media reports, Ideal Auto did not officially stop the parallel import channel until May this year, and cooperated with Sinomach Auto Co., Ltd. (Sinomach Auto) to establish a dealer network and after-sales system.

03 Shortcomings for Chinese car companies to make up

One of the importance of sales channels is after-sales service.

After a car is sold, its durability and whether problems are handled in a timely manner all affect the brand power and sales, and also affect the overall reputation of Chinese cars in Russia.

Looking back at relevant reports in recent years, Chinese cars have been caught in public opinion storms due to quality issues many times. In February this year, Russian Minister of Industry and Trade Anton Alikhanov announced at a State Council meeting that stricter certification and review would be implemented on cars from China, and the sales of many commercial vehicles would be suspended one after another.

Although this move is considered to be a measure by the Russian government to revitalize the local automobile industry and create buffer space for local companies, it is undeniable that Chinese cars have indeed encountered acclimatization in the Russian market.

In the early days of the Russian-Ukrainian conflict, due to the departure of European, Japanese and Korean car companies, the Russian automobile market showed a serious imbalance between supply and demand in a short period of time. According to statistics, Russia’s new car sales in 2022 fell 58.8% year-on-year, and production also fell to the lowest point in 30 years.

According to local media reports, in order to fill the market gap, the Russian government even amended the law to actively lower the factory standards for automobiles to increase production. At the same time, it also opened its arms to Chinese automakers and met market demand through direct imports.

As a result, there was an astonishing 340% year-on-year increase in exports in 2023.

But the “barbaric growth” in a short period of time has a price, the most fatal of which is the stability of the supply and marketing channels and after-sales guarantee. Eager to seize the market, some automakers have not been able to establish a complete parts supply chain, maintenance and after-sales system in the local area in a short period of time, or even up to now.

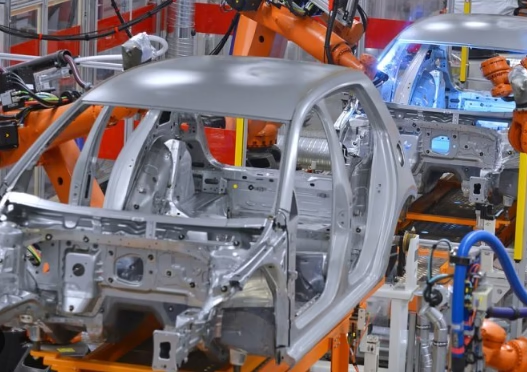

In addition, due to the uneven quality of exported models and Russia’s unique climate environment, Chinese brand cars have been repeatedly criticized for “poor adaptability”. Some media have reported that when compared with some European car brands, it was found that the metal bodies of some Chinese brand cars were not treated with anti-corrosion treatment, and they were prone to rust in an environment where the road surface was often icy.

Rather than saying that this is a poor quality, it is better to say that it is driven by huge short-term interests and has not done a good job of localization. Compared with the fine adjustment of vehicle design according to the local environment when exporting to Europe, the United States, the Middle East and even Southeast Asian markets, the export of automobiles to Russia is more like a barbaric growth of “selling what is available”.

04Facing a cooling market, Chinese automakers intend to reduce exports

In response to market changes, Chinese automakers are increasing their risk awareness.

According to Cui Dongshu’s data, from January to April, the sales volume of Chinese self-owned brand cars in Russia was 220,000, a year-on-year decrease of 30%. During the same period, exports to Russia decreased by 49%, a decrease higher than sales. “Chinese automakers in the Russian market have improved their risk prevention awareness,” Cui Dongshu commented.

In addition to protecting local industries, the overall cooling of Russian consumption is also an important reason for the decline in auto sales.

On December 20, 2024, local time, the Central Bank of Russia announced that it would maintain the benchmark interest rate at 21%. In March this year, the Central Bank of Russia predicted that the inflation rate in 2025 would be in the range of 7%-8%. According to data from the Russian Statistics Bureau, the year-on-year growth rate of Russia’s CPI in February 2025 reached 10.1%, far exceeding its expected target of 4%.

Inflation remains high, people’s purchasing power declines, Russia’s overall consumption is cooling, and the auto market is naturally affected. Coupled with the rapid growth of automobile sales in the previous three years, the market has also tended to be saturated. Overall, the decline in Russian automobile sales is inevitable.

According to the forecast of Autostat, a local automobile industry survey company, Russia’s new car sales will decrease by 10% year-on-year to 1.43 million in 2025.

Low-priced models are the most affected by the cold consumption. In addition, Russian domestic cars are mainly concentrated in the low-end market due to their weak technology and product strength. Cars at this price are most affected by protection policies. This is exactly the category of China’s largest automobile exports to Russia, which in turn amplifies its impact on the number of exported cars.

The new trend of exports to Russia this year is to focus on the mid-to-high-end and new energy markets. This year, the sales of brands such as Wei Brand under Great Wall, Jetour under Chery, and Avita under Changan have grown against the trend. New energy brands such as Ideal and Seres have also strengthened their channel network construction in the local area.

“Chinese auto brands occupy the mid-to-high-end market in Russia, and Chinese automakers have significant advantages in technology and products,” Cui Dongshu said. “The overall sales of new energy vehicles are good, especially high-end models such as extended-range plug-in hybrids.”

Faced with high uncertainty, Chinese automakers are also re-examining the Russian market.

Except for the Tula plant that Great Wall Motors laid out as early as 2015, there are no reports of Chinese automakers actually putting into production there.

Take Chery, the Chinese automaker with the highest sales in Russia, as an example. In the prospectus published for its listing in Hong Kong at the end of February this year, it clearly stated that it would reduce sales in Russia, saying that in view of the increasing business uncertainty, it would “reduce its dependence on Russia.”

Leave a Reply