Analysis of China’s New Energy Vehicle Market in February: Penetration Reaches 50%!

Even in one of the slowest sales months of the year for the Chinese auto market (due to the impact of the Spring Festival celebrations), new energy vehicles are still very popular in the Chinese auto market. Sales of new energy vehicles reached 686,000 units (the overall market size is 1.39 million units). Digging deeper into the data, pure electric vehicles (BEV) were the fastest growing technology type, with sales increasing by 94% to 427,000 units, while plug-in hybrid electric vehicles (PHEV) increased by 83% and extended-range electric vehicles (EREV) increased by 12%. This brings the cumulative sales volume to more than 1.4 million units year-to-date (YTD), and March is expected to be a strong month as well, and we expect sales to exceed 2 million units by the end of the first quarter. In terms of market share, the market share of new energy vehicles in February reached 50%! This is a full 15 percentage points higher than 12 months ago. BEVs alone account for 31% of Chinese car sales, which is also a significant increase from 22% in February 2024. This brings the market share to 45% in the same period of 2025 (33% in the same period last year). The market share of BEVs alone jumps to 27% (20% in January-February 2024). Considering that the last month of the quarter is usually the peak sales season, we can expect that China’s NEV market share will be close to 50% at the end of the first quarter and should remain above 50% in the first half of the year. (Will China’s NEV market share be close to 66% for the full year?)

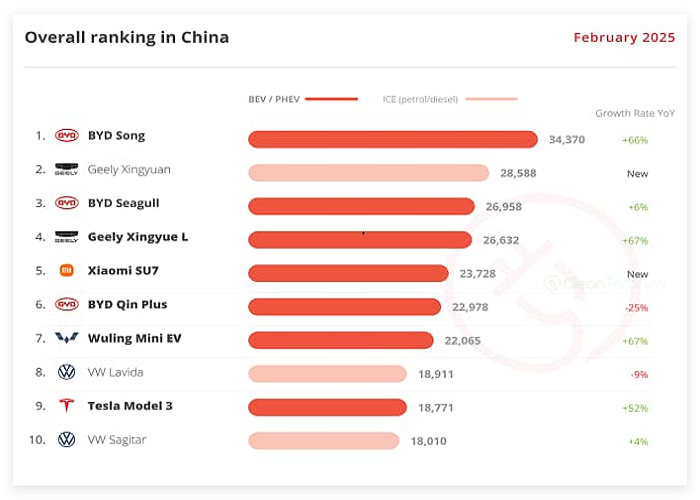

In terms of the overall ranking, as usual, internal combustion engine (ICE) models dominated the top positions at the beginning of the year, but not to the extent expected. A year ago, among ICE models, six models were in the top ten, while this time there were only three. The BYD Song was the top seller as always, but behind it, Geely continued to impress, with the Geely small car Xingyue taking the second spot. It was followed by the BYD Seagull in third place, and the Geely Xingyue L internal combustion engine mid-size SUV (also known as the Geely Haoyue and Renault Grand Koleos in export markets) in fourth place.

Looking at the best sellers in several different size categories, all but the C-segment (compact sedan) were led by NEVs. In fact, the C-segment was the only category where internal combustion engine models had two entries on the best sellers list, while in all other categories, internal combustion engines were in the minority. This was a recurring theme, and it seems that the C-segment is the category that has the most difficulty in transitioning to electric vehicles. On the positive side, this means that models like the Xpeng Mona M03 and Geely Galaxy E5 have a lot of room to grow… The biggest surprise was that Geely took first and second place in the B-segment, thanks to the Geely Xingyuan taking the first place, while its internal combustion engine crossover Binyue took the second place.

Leave a Reply